Where’s the Opportunity in Private Real Estate in 2024?

In this edition of the Bird’s Eye View, we highlight 3 strategies within private real estate that we think will offer opportunities for superior risk-adjusted returns in 2024, and share our thoughts on why.

If we were asked to review the 2023 private real estate market in the simplest possible terms, it would probably look something like this:

Private credit opportunities were excellent, thanks to higher interest rates.

Private equity deals were less excellent, thanks to higher interest rates.

As we look forward to 2024, the overarching questions in the market are when, and by how much, will interest rates fall, and for what reason. Will we see rate decreases before Q3 2024? Will we see a reduction of 50 basis points or 150 basis points? Will the driver for rate decreases be reining in inflation, or will it be recession?

While we don’t purport to know the answers to these questions, we think it is wise to embrace the ‘higher for longer’ mantra and prepare an investment strategy accordingly.

In this edition of the Bird’s Eye View, we highlight 3 strategies within private real estate that we think will offer opportunities for superior risk-adjusted returns in 2024, and share our thoughts on why.

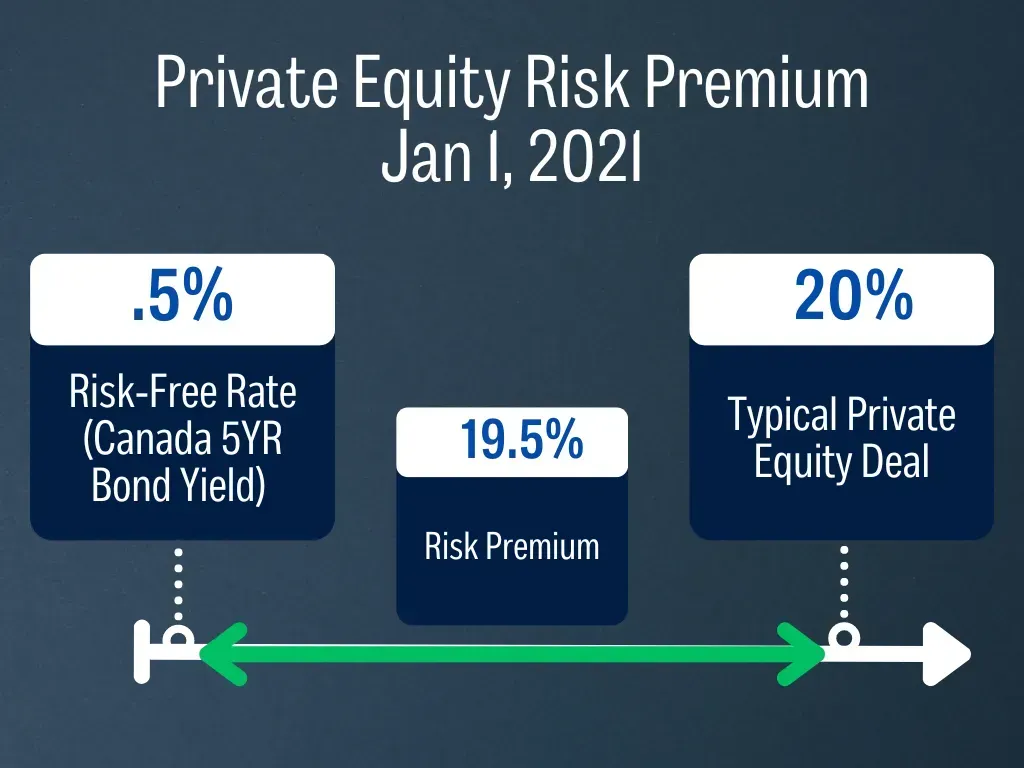

The Private Equity Risk Premium

Before we dive in, allow us a brief primer on risk premium.

Risk premium is the rate of return in excess of the “risk-free rate”, which you can expect to receive on risk bearing assets (for a strange example of negative risk premium, see our article “Making Sense of Negative Cap Rate Spreads”).

Understanding both the risks, and the risk premium helps investors answer the question, “am I being sufficiently compensated for the level of risk with this investment”?

The attractiveness of any given strategy changes as the underlying bundle of risks changes, and/or as the risk premium paid for that strategy changes.

A Typical Real Estate Private Equity Development Deal

Let’s consider a typical real estate private equity development deal to understand how the risk premium and underlying risks have changed between 2021 and 2024:

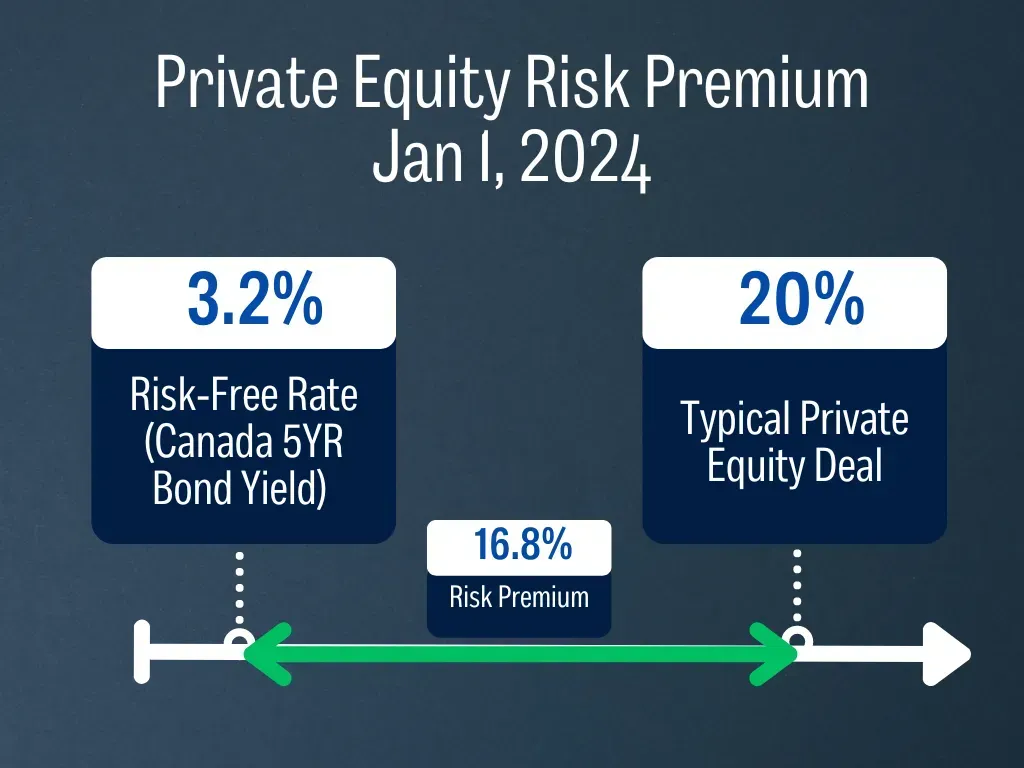

Off the top, note how the higher risk-free rate in 2024 cuts into the risk premium, meaning that even if deals are projecting similar returns, they are less attractive on a risk adjusted basis.

Second, and more interestingly, on the deals we have seen, projected deal returns between 2021 and 2024 haven’t changed much. Here’s why that’s problematic in many situations.

Most development deals rely on debt to some extent, and with higher interest rates, the costs of carrying that debt has increased, which pushes down returns.

To make up for this, we’ve found that a growing number of developers have used more aggressive assumptions in their underwriting to project similar levels of returns, such as projecting high rent growth, lower levels of vacancy, faster lease-up, future interest rate decreases, etc.

Reality may unfold in line with these more aggressive assumptions, though there is a lower probability of this happening.

In short, in the current environment the risk premium on development deals is lower, and in our view, the risk of not meeting projected returns is higher.

There are still excellent developers doing exciting deals, though to be attractive in this market, these deals have to be substantially de-risked, use conservative assumptions in underwriting, and present above average return potential.

With that framework set, let’s look at the areas where we think opportunities for superior risk-adjusted returns are most likely in 2024.

Areas of Opportunity

Mortgage Funds

We think that mortgage funds will continue to offer excellent risk-adjusted returns in 2024. When you can get equity-sized returns with debt-level stability and defensive positioning, investing in debt is something worth considering.

If you look at the TSX Composite Index, over the 50 year period from November 30, 1971 to November 20, 2021 the average annualized return was 7.94%. Debt products are delivering returns in this realm, if not higher. One of our fund partners delivered over 10% returns (net of fees) last year and is projecting similar returns this year.

Compared to the 2 year bond rate at ~4%, we think that the returns from our partner funds are highly attractive relative to the associated level of risk.

Select US Multi-family

Out of all of the asset classes we’ve invested in over the past 5+ years, US multi-family properties have been one of the hardest hit. There are many contributing factors, including rising interest rates, higher renovation costs, and substantially higher operational costs, particularly insurance and property taxes.

New residential developments that started two or three years ago during the strong market are now coming online, leading to increased vacancy and decreasing rental rates. Lenders are also more hesitant to lend in this environment, offering lower loan to values and more restrictive loan terms. The result? Many multi-family properties in traditional growth markets are down over 30% from peak pricing.

Identifying the bottom of the market is a difficult task, though we believe that in a world where high-quality assets are selling below replacement cost, there are likely to be some unique opportunities with an attractive risk-adjusted return.

One potential strategy may be to purchase these multi-family properties using very little debt, waiting for the market to improve, and then refinancing the property to return investor equity and increase returns. This would give investors the staying power to ride out any market turbulence over the next few years.

Special Situation Residential Development Deals

We are beginning to see another compelling category of deals; Canadian residential developments that started two or three years ago that need more cash to complete, usually due to higher than anticipated construction and interest costs. Many of them still look to be quite profitable as projected revenues have increased as well.

These types of deals have multiple benefits. Many of them have little to no entitlement risk as they are fully rezoned and have already received (or are about to receive) development and building permits. In a number of markets that we work in, particularly in BC and Ontario which are notorious for slow moving development processes, being able to remove development risk is a big advantage.

The second benefit is having much more clarity on costs and projected revenues, as we have the added benefit of additional information that the developer did not have at the time of purchase.

The last potential benefit is higher annualized returns due to having a shorter time-horizon than the original investors.

It all adds up to lower risk and potentially higher returns and we hope to see more of these “special situation” deals in 2024.

Conclusion

We are optimistic for a better environment for deals in 2024, particularly in the latter half of the year if interest rates start to come down. The quality of the deals that we are seeing has definitely increased over the last few months, maybe not to the point where we are proceeding, but some have been attractive enough to get a second or third look. This wasn’t the case for most of the deals we were seeing for most of 2023.

As always, we are here to bring you the best deals possible, and are prepared to hold off on doing equity deals entirely until we see an opportunity that meets our underwriting standards.

In the meantime we continue to believe that in this high-rate environment, investing in debt is a great option.