Why U.S. Multi-Family is Likely to Turn the Corner in 2025

Demand is high and has nearly chewed through the supply overhang in many markets, which should result in rising rents and falling vacancies over the next few years.

Introduction

The last couple of years have been painful for U.S. investors as housing prices have fallen and rent growth has stagnated or even gone negative in high supply markets. However, the pendulum is shifting and we believe that 2025 will be an excellent year to scale into multi-family housing in the U.S.

In this edition of the Bird’s Eye View, we walk through U.S. multi-family market data to share why we think that U.S. multi-family deals will outperform Canada in 2025.

The U.S. Bounce - Explained with 4 charts

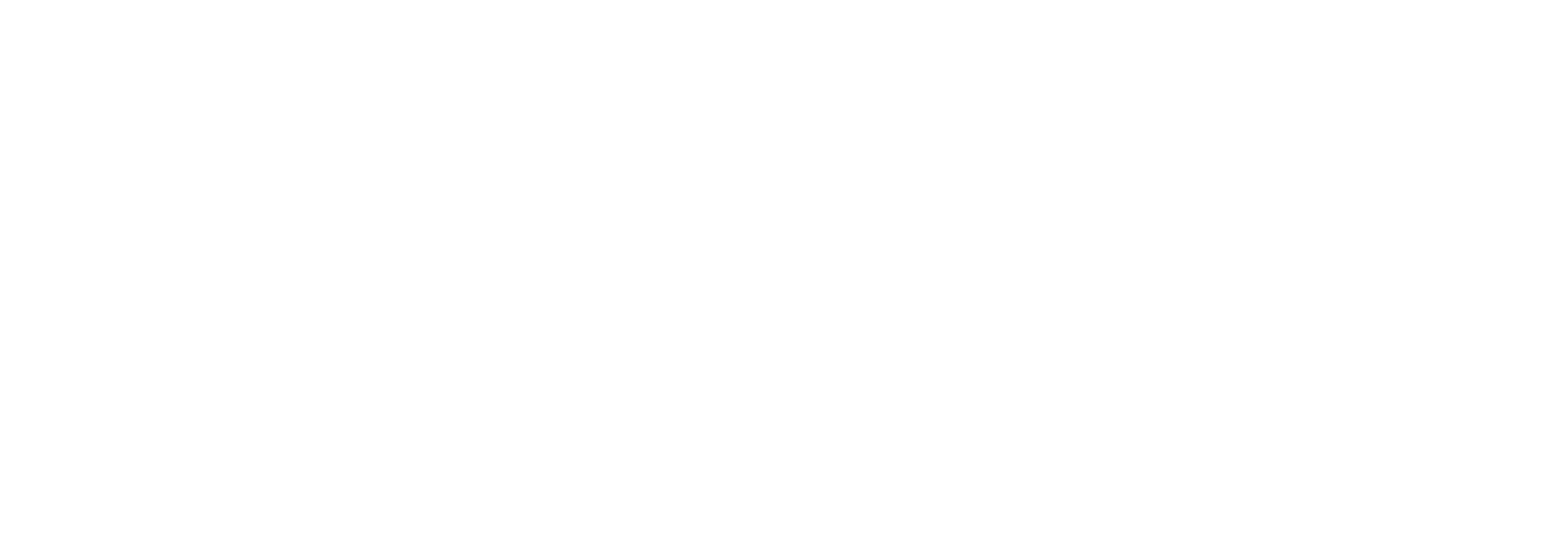

In response to the surge in demand for housing during the pandemic, the U.S. responded with an unprecedented wave of new housing projects. The result? For 13 straight quarters, U.S. multifamily has seen more net deliveries than units absorbed, which has led vacancy rates to climb from just under 5% in 2021 to over 8% in 2025.

Source: Co-star Data

There are two major points to glean from the chart above.

The first is that net deliveries peaked in 2024, and there is a steep decline in new units that are forecast to come online through 2028. At the end of 2024, there were only 560,000 multi-family units under construction in the U.S., the lowest number since 2018. Further, only 230,000 units broke ground in 2024, the lowest level of new construction starts since 2012. Supply is tapering, but demand remains high. (Source Cushman & Wakefield Q4 2024 U.S. Multifamily Report)

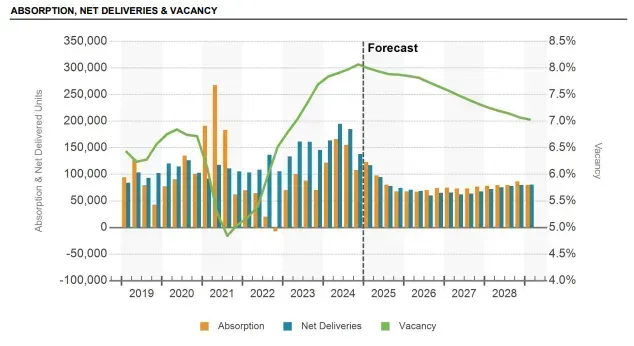

Second, vacancy rates for the U.S. as a whole likely peaked in late 2024. As expected from decreasing supply and vacancy rates, rents are expected to climb again in 2025 as shown in the chart below:

Source: Co-star Data

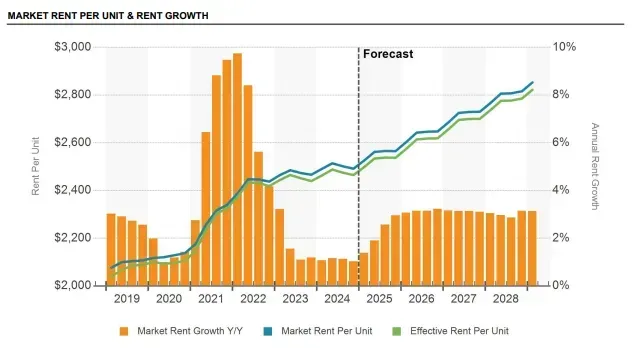

Cap rates are also at their highest levels since 2019, and are expected to remain reasonably high through 2025:

Source: Co-star Data

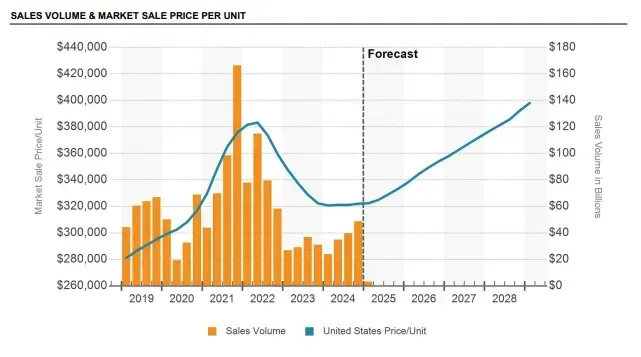

For investors, the set-up of high cap rates, decreasing supply and vacancy, high demand and increasing rents looks excellent, but this brings its own set of challenges, namely that many people see it coming. Transaction volumes have been low, as even those who want to sell are doing what they can to arrange financing that will allow them to hold on until they can sell in more favourable market conditions. As shown below, 2023 and 2024 saw extremely low levels of sales volume, and that likely won’t change dramatically through 2025:

Source: Co-star Data

All this is to say that while 2025 may be an interesting time to invest in U.S. real estate, there won’t necessarily be good deals everywhere you look, particularly since there is so much variance between submarkets.

For example, we closely follow the Dallas-Fort Worth metropolitan area, and we don’t expect the market there to turn until 2026. Dallas-Fort Worth led the nation both in number of units delivered in 2024 (41,018, representing 4.6% of total inventory) and units absorbed (30,718), but it still has another 35,532 units under construction. With vacancies at 11.2% and 12-month rental growth coming in at -1.2%, it will need more time than other areas of the U.S. to work through its supply overhang. The seeds of future supply crunch are being sown however, as there were only 19,930 new starts in 2024, compared to the 35,709 in 2023 and 39,213 in 2022.

That said, in some ways, the later expected turnaround makes it more likely that deals will come up in 2025, so just because a market isn’t quite ready to turn doesn’t necessarily mean that it isn’t worth looking at if the right deal comes our way.

Conclusion - It’s Time To Be Looking

In our view, it’s a great time to be looking for opportunities in the U.S.

Cap rates are comparatively high. Demand is high and has nearly chewed through the supply overhang in many markets, which should result in rising rents and falling vacancies over the next few years.

For those investors that have been carefully holding on to capital to take advantage of distress, we anticipate that 2025 will present unique opportunities with the best risk-adjusted return potential we’ve seen in years.

We have already found one U.S. deal that we are excited about this year, and suspect that with the way markets are shaping up, more are coming.