Conservative vs. Liberal Election Primer - Housing Policy

Introduction

Election season is here, and while housing affordability and availability have taken a backseat to how Canada should approach its relationship with the United States, changes to housing policy still feature as central pillars of both the Conservative and Liberal party platforms.

What makes their proposed changes particularly notable is that since the 1980s, the Federal Government has played a smaller role in housing compared to Municipal and Provincial governments, influencing markets indirectly through immigration and monetary policy. Those days look to be over, as both parties have introduced proposals that would see the Federal Government take a much more active role.

In this edition of the Bird’s Eye View, we review the housing platforms for both the Conservative and Liberal parties, and offer our opinion on how these policies will impact development generally, and real estate investors specifically.

Note: We recognize that other parties also have housing platforms, but for brevity, we are only covering the Conservative and Liberal platforms.

Policies in Common Between Conservatives and Liberals

Before we dive into the novel proposals from each party, we begin with three policies in common:

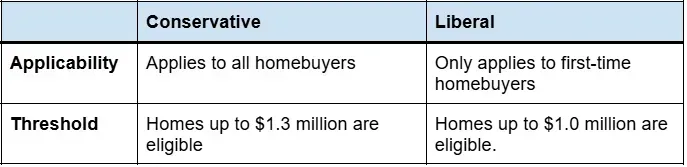

1. Elimination of GST on new homes

Both parties have proposed to eliminate GST on new homes, but there is a massive difference in the size and scope of the two programs:

Source: Conservative party website and Liberal party website, data compiled by Hawkeye Wealth

Our take:

These two policies may have the same target, but they have completely different levels of relevance. The Liberal program will benefit a much smaller number of purchasers given that only first-time homebuyers are eligible, and at a lower threshold value.

Quantifying the size of the difference between these policies is not as easy as it seems, as the publicly available data on the proportion of first-time buyers that purchase new homes is weak. CMHC data shows that first-time homebuyers were responsible for 55% of new mortgages in 2023 (page 8), but we suspect that first-time homebuyers are much less likely than repeat buyers to purchase new homes, which further reduces the relevance of the Liberal policy.

Overall, both of these proposed policies are positive, but the Conservative policy is much more likely to actually move the needle on housing prices.

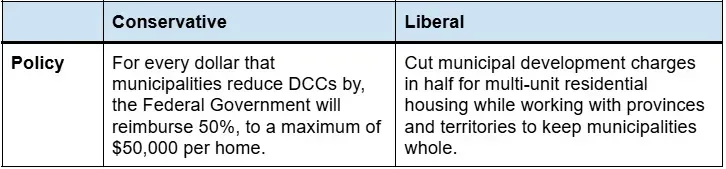

2. Incentivizing municipalities to cut Development Cost Charges (DCCs)

Both parties say that they will work to reduce DCCs, though their approach varies:

Source: Conservative party website and Liberal party website, data compiled by Hawkeye Wealth

Our take:

Though neither of these programs have been fleshed out, there is a fair bit to glean from the little bit we do know. First, and most problematic, under both programs it is the municipalities that raised their DCCs the most over the last few years that stand to receive the greatest level of financial support from the federal government. In contrast, the municipalities that tried to keep DCCs to reasonable levels might be out of luck unless accommodations are made as these programs are built out.

Second, the Conservative plan has municipalities absorbing 50% of the cost reduction, while it sounds like the Liberal plan has the federal government paying for 100% of the reduction in DCCs. Both are likely to be effective in achieving drastically reduced DCCs, but the way the governments would get there will be different. We do think the Conservative plan will be effective in incentivizing municipalities to decrease DCCs, but they will also likely increase property tax rates to offset revenues forgone. Under the Liberal plan, either taxes will need to rise, other services will need to get cut, or most likely, the costs will get added on to the ever-growing national deficit.

The devil will be in the details, but any move that sees DCCs getting chopped will be favourable for Canada and for investors.

3. Speeding up zoning and permitting processes

Both parties acknowledge that zoning and permitting processes need to be faster and less costly, but the Conservative party will mostly use a big stick to get there, while the Liberal Party will use a fat carrot.

The Conservatives will require municipalities to build 15% more homes each year (compounding). If targets are missed, then a portion of federal funding will be withheld until they catch up. If targets are exceeded, municipalities will receive bonus funding.

The Liberals propose to speed up processes by expanding on the Housing Accelerator Fund, a fund intended to provide financial support for those communities that are working to reduce red tape in the building process. The theory is that this will result in lower building and administrative costs for developers, thereby enabling more building. To date, over $1.0B of the $4.4B fund has been awarded, but it isn’t clear whether this has resulted in projects that are materially faster or lower cost for developers.

Our take:

The idea of the Housing Accelerator Fund isn’t inherently bad, but the effort to create bespoke solutions for each applying municipality is always going to be slow and difficult to oversee. It’s a new program (launched in 2023) so we are hesitant to judge it before homes are even complete, but to date, the current iteration doesn’t appear to be working as envisioned.

We think that there is a quiet elegance in the Conservative approach of setting a clear expectation for municipalities, but not prescribing the methods they use to get there. Our favourite part about this plan is that it forces a fundamental change in the municipality vs. developer mentality that exists in many municipalities. Municipalities will only be able to achieve their goals with the help and investment from private developers, which should in theory materially change interactions between the two.

This also allows municipalities the autonomy to customize how they get to their building targets. Whether by implementing tax cuts, refining and improving zoning and permitting processes, or lobbying the Province for building code changes.

The key downside with this approach is that municipalities don’t control market factors, meaning that even if they are doing all the right things, it’s wholly possible that investors and developers may not line up to build, and the hammer of potentially losing federal funding on top could put municipalities in a difficult position.

Liberal Platform

The Liberals have proposed two novel policies:

1. Build Canada Homes

The cornerstone of the Liberal housing plan is to double the pace of construction to almost 500,000 new homes per year by acting as a developer to build affordable housing at scale, including on public lands.

This plan also proposes to provide $25B in financing to prefabricated home builders, and $10B in low-cost financing and capital to affordable home builders.

Our take:

This plan won’t work. It won’t even come close to enabling 500,000 new homes to be built annually, and has the potential to seriously disincentivize private building.

The often cited precedent for this plan is the highly successful public building program implemented in Singapore, which has overseen the development of more than 1 million units, housing approximately 77% of Singapore’s population. Conversely, only 23% of homes in Singapore were privately built.

After thoroughly reviewing the Singapore public building program, there are so many conditions necessary for its success there that don’t exist in Canada.

If the Liberals win this election, we will release a full article on why the Singapore public building program has been so successful, the reasons why it will be difficult to port to Canada, and why we believe the Build Canada Homes plan is destined to fail.

In the meantime, we have no confidence in any government's ability to deliver on this promise.

2. Re-introduction of the MURB Tax Measure

The Multiple Unit Residential Building (“MURB”) program was implemented from 1974 to 1981 (excepting 1980). Its function was to relax the capital cost restrictions of the Income Tax Act to allow Capital Cost Allowances to be deducted against any income, as opposed to just income from the property, acting as a tax deferral mechanism. The hope was that this would be a sufficient incentive to stimulate the construction of rental housing.

This program also allowed for the immediate deductibility of developers’ soft costs (mortgage insurance, landscaping, interest, property taxes, etc) incurred during construction.

A 1988 CMHC Assessment Report of the MURB (and other federal rental housing programs) says the following about the programs attractiveness to investors:

Much of the attractiveness of MURB's from the investor's perspective derived from the ability to leverage the investment where a substantial proportion of the project cost was financed by borrowed funds. Since the investor could claim the entire CCA and/or soft costs associated with the project, the magnitude of the deductible loss relative to the size of the initial investment could be large.

Our take:

The details of what this iteration of the MURB might look like aren’t known, but we anticipate that the two key features of the previous iteration of allowing CCAs to be deducted against any income, and for immediate deductibility of soft costs would return.

This program received a fair bit of criticism for other reasons, but it is a definite advantage for investors. With what we know today, it isn’t likely going to be enough to overcome the downside potential of the Build Canada Homes plan, but on its own, this would be a welcome policy for investors.

Conservative Platform

In addition to the policies in common covered above, the Conservatives have proposed three other policies to support homebuilding:

1. Sale of Federal Lands

The Federal Government owns 37,000 properties, and intends to sell 15% of these properties to be used to build new homes.

Our take:

There are thousands of unutilized or underutilized federal properties, so putting these properties to better use makes sense. It isn’t clear whether these lands would be sold at market value or not, or whether there will be some type of a deal if developers covenant to immediately build housing on the land. The answer to that question will likely affect program uptake.

Selling land is permanent and should always be done thoughtfully, but there is a clear and present need.

2. More Boots, Less Suits

The Conservatives would fund 350,000 positions over 5 years to train red-seal apprentices by expanding the Union Training and Innovation Program. They would also reinstate apprenticeship grants of up to $4,000.

Our take:

While this won’t do anything to solve the immediate housing crisis, it does address one of the underlying issues that is making solving the housing crisis so difficult. Without the labour necessary to ramp up development, housing targets are largely meaningless.

Programs like this are essential and should be commenced immediately in order to ease future housing pressures.

3. Canada First Reinvestment Tax Cut

This program would allow investors to defer capital gains if they choose to re-invest in Canadian investments. While not exclusive to housing, housing would be an eligible investment so we include it here.

The intent is that this program would function similarly to the 1031 exchange that is popular in the U.S., except that it would be applicable to all Canadian assets, not just real estate.

Our take:

This is a clear win for all investors and for Canada. Frankly, we wish this item would have received much more attention from the Conservatives, as it hasn’t been regularly discussed in the media or in debates.

This is a simple policy that could serve as a major catalyst for investment in Canada. As long as you continue to re-invest in Canada, you can chain together capital gains deferrals, allowing your investments to compound faster. You would eventually need to pay capital gains if you choose to cash out or invest in a non-Canadian asset, but the compounding benefit would be substantial.

Conclusion

All of the Conservative proposals would be positive for housing investors and developers. The majority of Liberal proposals would also be welcomed by investors, but their Build Canada Homes program has the potential to overshadow all of their other initiatives and squeeze private developers and investment from the market.

In a little more than one week we will have a new government, and whatever the result, we will be here working to identify the best risk-adjusted investment opportunities in the market.