Where Are The Wealthy Putting Their Money?

Introduction

"It was never my thinking that made the big money for me. It was always my sitting. Got that? My sitting tight!" - Jesse Livermore

“The big money is not in the buying and the selling, but in the waiting” -

Charlie Munger

It’s easy to feel unconfident as an investor today. We are currently operating in a market of ‘brittle optimism’, where major indices flirt with all-time highs while headlines warn of trade wars, a potential AI bubble burst, and the destabilization of institutions.

For many people, the natural instinct in the face of volatility and future uncertainty is to protect what they have by taking defensive positions, hedging, or selling altogether until the future feels rosy again.

But that doesn’t appear to be what the wealthy are doing. In this edition of the Bird’s Eye View, we consider the data from three wealth reports (Tiger 21,

Knight Frank, and

Capgemini) to see how different cohorts of the wealthy are positioning their portfolios, and how their portfolio construction is changing in response to uncertainty.

Asset Allocations by Investor Profile

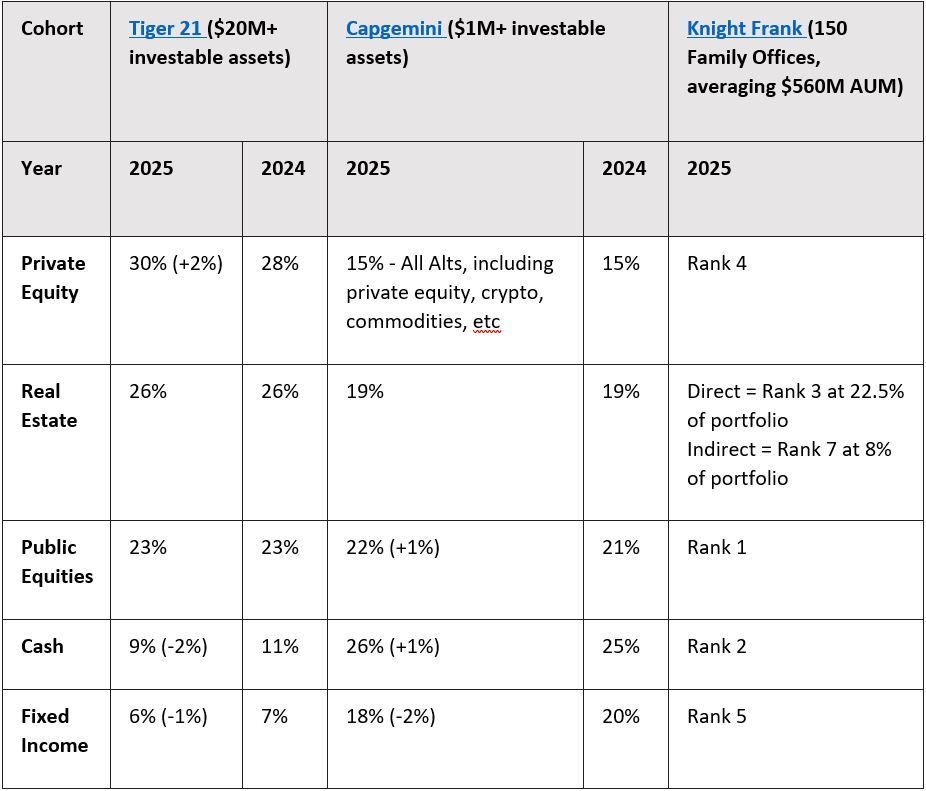

The table below represents the most recent reported weightings and rankings across the three major cohorts. Note that while Tiger 21 and Capgemini provide percentage-based portfolios, the Knight Frank data reflects rankings by weight within institutional family offices.

Source: Table created by Hawkeye Wealth, based on Tiger 21,Knight Frank, andCapgemini data

Understanding the Cohorts

To find the signal in this data, we must understand the differences between these groups of wealthy. The portfolio allocation differences between the cohorts sampled in these reports are a reflection of different approaches that people with different levels of wealth tend to display on average.

Tiger 21 Entrepreneurs: Active Capital

Tiger 21 members must have $20M+ in investible assets to join. These are mostly former entrepreneurs with high risk tolerance who went from running their businesses to actively managing their newfound wealth after a liquidity event.

The Tiger 21 data is revealing because of how it is collected. Instead of the typical anonymous survey, the data comes from the “portfolio defense” presentation that members make to their peers each year, defending their investment decisions and the reasoning behind each position.

We suspect that the peer-to-peer justification, reflected in their much lower levels of cash (9%) compared to other HNWIs (High Net Worth Investors). While they hold similar levels of public equities and real estate as other HNWIs, they have a larger 30% allocation toward private equity, demonstrating a preference for investments where they have specialized knowledge, influence or control.

The Average High Net Worth Individual: A Preservationist

The vast majority of respondents in the Capgemini survey are people with investable assets in the $1M to $5M range (89.8% of respondents). These are the "Millionaires Next Door" who built their wealth through traditional careers or small businesses.

This group has enough money to live comfortably through retirement, provided they avoid major missteps. That need for safety is reflected in their heavy 26% allocation to cash and 18% to fixed income. They hold significantly less in real estate and alternative investments.

The cost of this ‘safety’ clearly manifests in stronger markets. From 2023-2024, these investors increased their wealth by 2.6%. Meanwhile, UHNWIs (Ultra High Net Worth Individuals - $30M+), who held much lower levels of cash and fixed income, grew their total wealth by 6.3% over the same period.

Family Offices: Balancing Growth and Preserving Generational Wealth

The Knight Frank data samples institutional family offices with an average of $560M of assets under management.

Between direct ownership (22.5%) and indirect ownership (8%), family offices hold a higher proportion of real estate compared to other HNWI portfolios. These offices aren’t always trying to hit home runs with their real estate because it serves so many useful functions for family offices, from capital appreciation and income generation, to wealth preservation and geographic/sector diversification.

The Knight Frank data indicates that on average, family offices are targeting an annual unleveraged return of 13.8% on their real estate holdings. Their allocations strike a middle ground between the high cash and fixed income positions of the HNWIs sampled by Capgemini, and the high private equity allocations of the UHNWIs sampled by Tiger 21.

The Commonality: Subtle Shifts

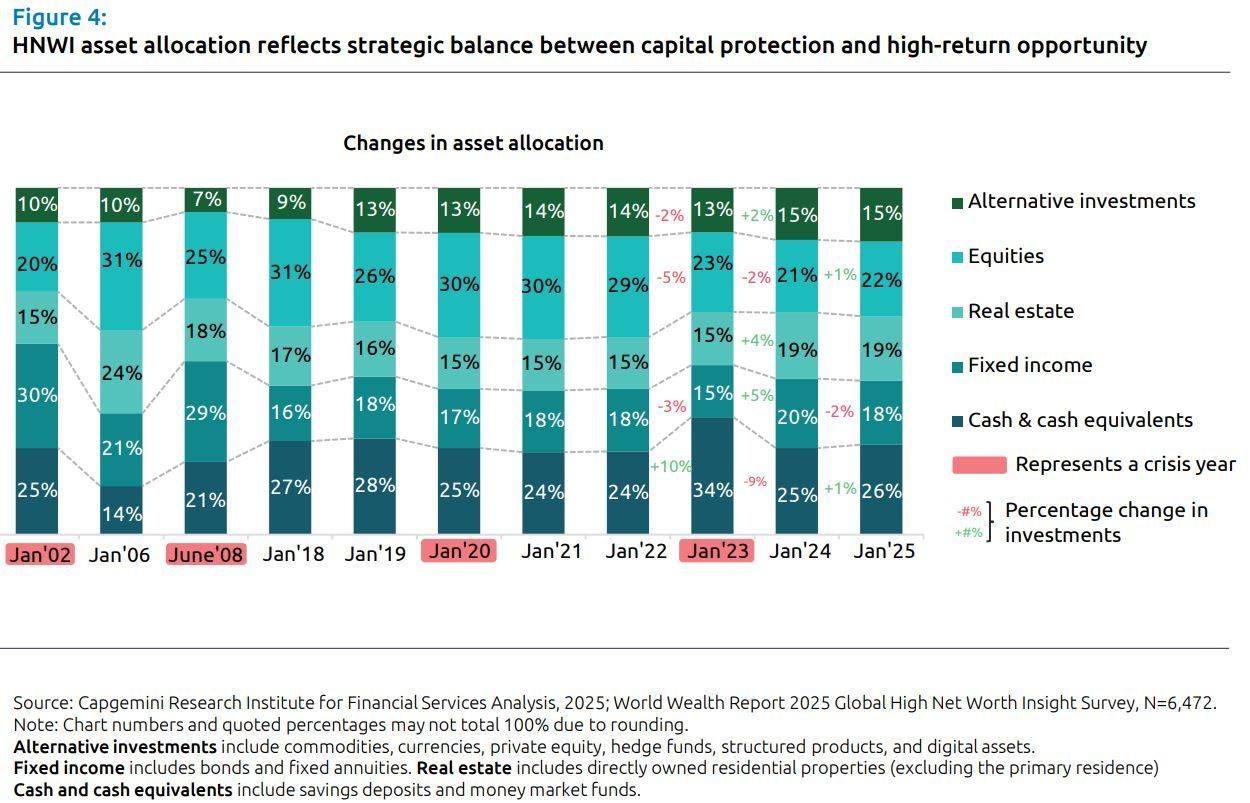

While each cohort has different levels of wealth and goals, the overall allocations tend not to change much from year to year. Even through periods of crisis, these investors don’t make radical changes. The wealthy as a whole tend to avoid impulsivity and practice patience.

The Chart below shows asset allocation percentages since the turn of the millennium:

Source: Capgemini, World Report Series 2025

Conclusion

If world affairs or headlines have you feeling anxious, it can be helpful to step back and review your portfolio in a broader context. Are you feeling uneasy because your exposure no longer aligns with your long-term goals, or simply because short-term noise is dominating the conversation?

The data suggests that many wealthy investors are not attempting to outmaneuver markets through dramatic shifts. Instead, they focus on constructing portfolios that support their long-term goals and will be resilient across cycles, allowing them to remain patient through uncertainty.