A Poor Man's Guide to Market Assessment

"We may never know where we’re going, but we’d better have a good idea where we are."

- Howard Marks

“It’s a great time to be investing capital. We’ve been doing it for the last 6 months in real estate. I expect you’ll see a lot of it in the back half of the year as well”.

- Jon Gray, Blackstone President, July 25, 2024

“It’s too early to buy distressed CRE…If the economy starts to slow down more meaningfully, as the consensus expects, the problems for rental housing, multifamily, and warehouses will get a lot worse.”

- Torsten Sløk, Apollo Chief Economist, August 16, 2024

Jon Gray and Torsten Sløk, leaders in their respective multi-billion dollar funds have drawn their lines in the sand on real estate. While we don’t know which of these predictions will prove more correct, the fact that they are so opposed is a stark reminder that even the most skilled investors struggle to precisely predict the peaks and troughs of market cycles, both in terms of extent and timing.

Howard Marks, another distinguished investor, makes the case that investors shouldn’t overly concern themselves with guessing the future, and should keep their primary focus on current conditions:

Most people strive to adjust their portfolios based on what they think lies ahead. At the same time, however, most people would admit forward visibility just isn’t that great.

That’s why I make the case for responding to the current realities and their implications, as opposed to expecting the future to be made clear. (The Most Important Thing, Chapter 15)

In this edition of the Bird’s Eye View, we discuss the importance of focusing on the current state of the market, and share a practical exercise from Howard Marks called “The Poor Man’s Guide to Market Assessment”, that can help you with that. We will also share how we’ve adapted that assessment to allow us to better gauge and compare markets over time.

The Poor Man’s Guide to Market Assessment

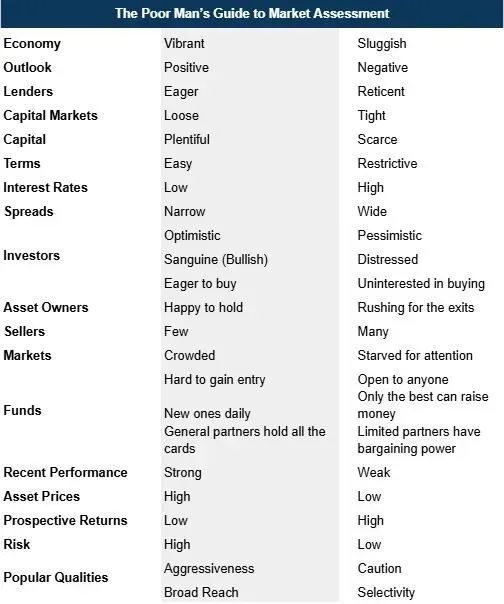

In Chapter 15 of The Most Important Thing, Howard Marks introduces “The Poor Man’s Guide to Market Assessment” by saying:

I have listed a number of market characteristics. For each pair, check off the one you think is most descriptive of today. If you find that most of your check marks are in the left-hand column, as I do, hold on to your wallet.

Try it yourself: As you read through the assessment, consider how each characteristic applies to a market that you follow closely. What trends do you notice?

I suspect that for the most part, your answers landed primarily in the right column.

The Poor Man’s Guide to Market Assessment is much as the title implies, a quick and dirty exercise to gauge the position of a market. In the simplest terms, it aims to determine what the herd is currently doing.

We want to know what the herd is doing so we can do the opposite. Warren Buffet offers the famed advice that investors should, “be fearful when others are greedy, and be greedy when others are fearful”.

When you hear things like “which options should I buy with my Covid relief (CERB) money”? or when banks begin offering NINJA mortgages (No Income, No Job or Assets), it’s time to be fearful. It’s easy to spot market froth with hindsight, but it’s considerably harder to avoid poor decisions when you find out that your 15 year-old neighbour became an overnight millionaire with some obscure cryptocurrency.

On the other hand, it is equally difficult to muster the confidence to purchase assets when it seems like all you read is bad news about the current economy and future prospects.

The Modified Poor Man’s Guide

Since October 2022, our team has completed a modified version of the Poor Man’s Guide to Market Assessment each month.

We’ve adapted the assessment by adding a scoring system, with the characteristics on the left earning a positive value and those on the right, a negative one. The results allow us to quickly evaluate market trends and better quantify how strongly market sentiment is leaning.

Each month this assessment helps us break out of the herd mentality, and gives us directionality on which real estate markets we should focus on, based on where fear is the highest.

For example, in Vancouver, many of the market characteristics are in the right-hand column, but there are other characteristics, such as stubbornly high asset prices that balance out the overall score. Unless there is an exceptional deal on the table, this exercise points to markets where scores are more deeply negative.

Limitations of the Assessment

There are some inherent limitations to this assessment worth noting:

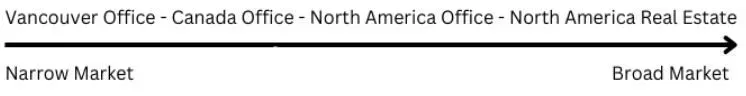

1. This exercise is much more precise, and therefore more valuable for decision making, when applied to narrow markets.

Example:

2. This exercise was never meant to have scores attached to it. That said, if you do decide to take a similar approach, we recommend giving consideration to assigning higher weights to the most important characteristics. For example, the Asset Prices characteristic might have a higher weighting than other characteristics. For us, the aim was to get this to a spot where the scores accurately reflect the conditions and sentiment we see, which required some manipulation.

3. If being used for comparison purposes, such as comparing sentiment scores between Nashville and Calgary multi-family markets, a fair amount of market specific knowledge is required to accurately answer the questions.

4. It’s a starting point for further analysis and research, not an ending point.

Conclusion

In the words of Howard Marks, “We may never know where we’re going, but we’d better have a good idea where we are.”

We aren’t Jon Gray or Torsten Sløk, and we don’t know whose prediction will be more correct in the future.

What we can comfortably say is that while Apollo may be right that there is more pain ahead, from our perspective, it’s also the case that most real estate markets in North America are experiencing at least some degree of pain in the present.

Investors that stay sensitive to those markets that are experiencing the most bearish market characteristics will be well positioned to take advantage of deals as they arise.