Investing in Canadian Farmland

Introduction

Canadian farmland hasn’t posted a single annual decline in value since 1992. Take a second to soak that up. More than thirty years, multiple recessions, inflation spikes, a housing crash and a tech- bubble. Through it all, farmland kept climbing.

In a world where many asset classes appear vulnerable to technological disruption or shifting consumer preferences, the core value in farmland is tied to a necessity that will always remain constant. Food.

In this edition of the

Bird’s Eye View, we discuss the case for investing in Canadian farmland and share the most compelling points and potential risks from our due diligence on this asset class.

The Investment Case for Canadian Farmland

In our view, farmland has six main features that make farmland investment attractive:

1. Consistent Performance and Low Volatility - A 30+ year track-record of positive annual returns is astounding, even more so when you consider that the

average annual increase over that period has been 8.1%.

Past performance doesn’t guarantee future returns, but there is merit to the fact that farmland has been remarkably consistent through periods of high market volatility. When considering that the figures above don’t account for any profit from the land, farmland has done an impressive job of delivering returns comparable to U.S. equities, but with a volatility profile that more closely resembles bonds.

2. Natural Scarcity - Most cities are established near fresh water and fertile soil. Thus as populations grow and cities expand, that development inherently reduces the base of potential farmland.

While most provinces have some level of agricultural land protection program in place, the fact remains that there is a finite amount of farmable land, and each year there is less of it.

3. Diversification and Inflation Hedge - Farmland has a long track record of holding its value when inflation eats away at other assets. Rising food prices translate directly into stronger farm revenues, which in turn support rental income and land appreciation.

Additionally, over the last 50 years,

farms have averaged an increase in productivity of ~1.5% per year by adopting new technology and processes (machinery, irrigation, nutrient management), which serves as a natural inflation hedge.

Unlike equities or bonds,

farmland’s performance has shown little correlation with public markets, giving it genuine diversification benefits.

4. Investor-Tenant Alignment - For anyone feeling exhausted with the rhetoric about ‘greedy developers’, it may come as welcome news that investors and landlords aren’t automatically the bad guy in the farmland space.

Research shows that

farmers are able to drive higher levels of profitability per acre when renting compared to when purchasing farmland, and that trend is accelerating. While renting doesn’t necessarily outperform ownership over the long-run when accounting for land appreciation benefits, it does improve cashflow. Since farming is capital intensive, renting land allows farmers to allocate funds that would have otherwise gone to land, toward equipment and operations that improve yield and profitability.

Since farmers’ profitability depends on sustaining yields, they are naturally incentivized to care for the soil and manage the land well, which not only supports their own returns but helps preserve and even enhance the underlying land value. As a result, the ‘renter’s mentality’ sometimes seen in other real estate sectors is far less common in farming.

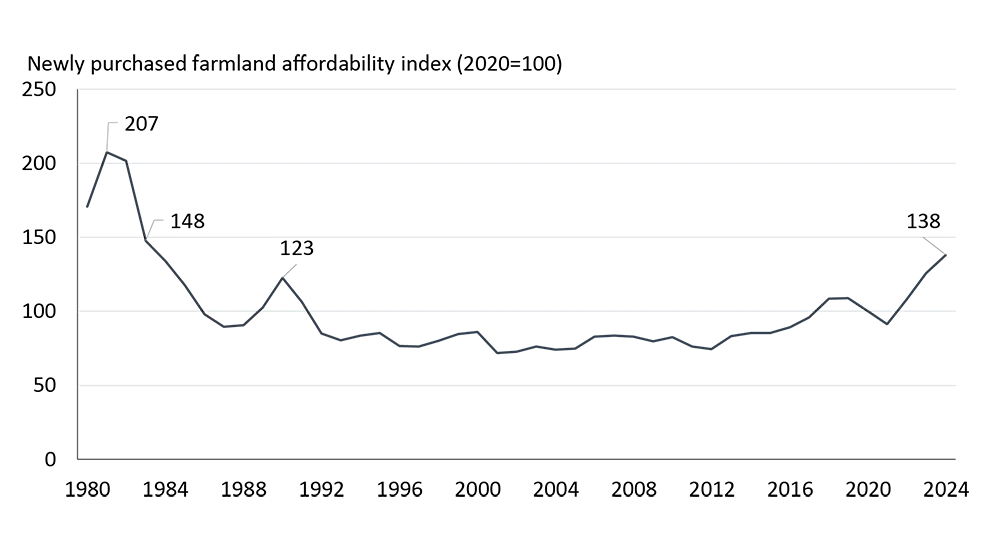

5. Comparative Affordability - In housing, the current challenge is that people can’t afford to pay what developers can feasibly build. In comparison, while farms are comparatively less affordable than they were 5 years ago, the gap is far less dramatic than it has been in housing.

Farm values and rents have rapidly increased, but the

revenue generated by those farms has also substantially increased, which has slowed the loss of affordability. While current affordability levels are still a concern in the space, farmers can still operate profitably at current price levels and as shown on the chart below from

Farm Credit Canada, we are nowhere near the peaks of unaffordability that farmers experienced during the 1980’s:

Sources: Statistics Canada, FCC Calculations

6. Sector Protection - Wrapping up our comparison to housing, the government is highly motivated to support farmers at all levels and across party lines. Food security continues to be a major focus for governments and that is reflected in regulation and subsidy programs.

Each province in Canada also offers crop insurance, which protects against things that can destroy or reduce crop yields, such as drought, flood, frost, hail, pests, and disease. The premiums for this insurance are partially subsidized by Provincial governments.

We don’t profess to know enough about canola markets or the newly launched $370M Biofuel Production Incentive to measure its effectiveness in the face of China’s massive tariffs on canola, but coming from housing, the level of tangible support and positive rhetoric is a difference between night and day.

If you can’t beat em’, join em’?

Farmland Investment Risks

While we think the positive features outweigh the potential drawbacks, we will keep things balanced by presenting 6 potential risks with farmland investment:

1. Specialized Knowledge Requirement - This isn’t a sector you can just jump into. Farmland investing works best when you have farming expertise on your team, or a manager with deep agricultural experience. Without that, it’s easy for assets to underperform.

2. Slowing (or negative) Population Growth - Food demand ultimately follows population and consumption trends. If growth slows or declines in key markets, demand for agricultural products could soften. Globally, the trend is still toward rising food consumption, and we don’t see that shifting in the near future, but local shifts could influence land use, rental demand, and commodity prices.

3. AI and Technology Improvements

- New technology, whether AI, automation, or vertical farming, could boost productivity per acre. That’s usually good for farmers, but if each acre produces more, we may need less farmland overall. This could impact long-term land values.

4. Adverse Weather and Climate Change

- Crop insurance and government programs cover many year-to-year risks, but nothing protects against gradual, structural shifts. Prolonged droughts, soil degradation, or flooding could reduce yields and impact both rental income and long-term land appreciation.

5. Illiquidity - Farmland isn’t something you can sell on a whim. Transactions take time, and finding a buyer, or even exiting a farmland fund can take months. New structures may help limit this challenge in the future, but from the models we’ve reviewed, this is a long-term commitment.

6. Market and Commodity Price Risk

- Farm revenues depend on commodity prices, input costs, and global trade. Tariffs, trade disputes, or changing consumer demand can all affect profitability, and by extension, rental income or debt repayment. There is currently strong government support that partially offsets these risks, but that isn’t always guaranteed.

Conclusion

Farmland may never be the investment that gets everyone talking at a cocktail party, but that’s

exactly why we like it. It’s steady, it’s essential, and it keeps producing value year after year. For long-term investors, that kind of quiet reliability is attractive, particularly since historical returns have kept pace with the market.

Of course, it’s not without risks. Specialized knowledge, weather and climate concerns, technology adaptation, and illiquidity all require thought and care. But for investors willing to take a long-term view, farmland offers a rare combination of tangible value and resilience that’s hard to find elsewhere.