Profiting in the Energy Efficiency Era

Government plays a massive role in the supply and demand equation for housing. From the Federal down to Municipal governments, there are dozens of policies that affect housing.

As an investor, you don’t need a deep understanding of the policies themselves, though you do want to understand the effects these policies have.

This edition of the Bird’s Eye View will look at BC’s Energy Step Code program, outline how it is affecting development in BC, and conclude with how investors can best position themselves as governments march toward ‘net-zero’ housing.

While this article focuses on BC, the trend of requiring more energy efficient housing appears to have some degree of national traction, and we anticipate that these types of policies will become more common in all Provinces, though the specifics will likely differ.

BC Energy Step Code

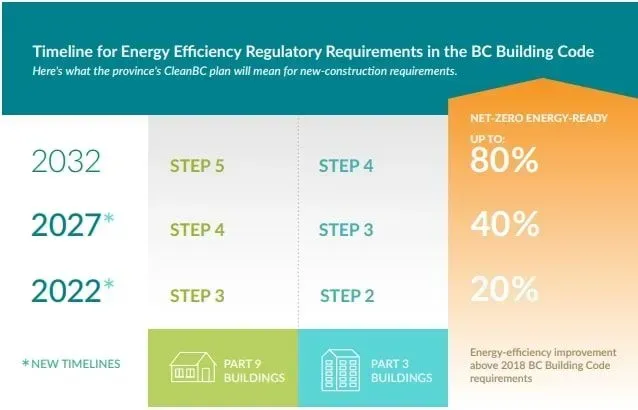

In BC, the Provincial Government’s plan to increase the energy efficiency of newly built, and renovated buildings, is called the “BC Energy Step Code”.

Developers need to get into the weeds and work with “energy advisors” to review plans, model energy consumption, and ultimately, ensure that certain energy efficiency thresholds are met.

As investors, what you need to know is that today, all new buildings in BC must be 20% more energy efficient than they were required to be in 2018. By 2027, that number will be 40%, and by 2032, a whopping 80%, where new buildings will be “net-zero energy ready”.

However, municipalities may choose to implement these timelines even sooner. Some municipalities, such as Richmond, Surrey, North Vancouver and West Vancouver, have already implemented municipal bylaws to accelerate these timelines.

What will the BC Energy Step Code do to housing supply and costs?

Energy efficient buildings are an admirable goal, though as with anything else, there are tradeoffs.

A 2019 modeling study by the Homebuilders Association of Vancouver (HAVAN) articulated that implementing step 5 increased building costs by as much as $48,220 for a typical house, and that Custom-built homes could incur even higher expenses.

In reality, most builders have been able to satisfy the requirements of Step Code level 3 by making minor tweaks to building materials, at slightly higher build cost. However, there is concern from many in the development community regarding steps 4 and 5.

Hawkeye has spoken with two developers recently who have shared these insights regarding the BC Energy Step Code:

"Level 4 and 5 are major hurdles and require more than just using different materials. Those levels require changing how buildings are planned and constructed. If we needed to build a Step 5 building today, we quite literally wouldn't know how to do it. We will get there, I'm sure, but it will take time, effort, and money. I suspect that some developers will just phone it in rather than learn a new game."

- BC Multifamily Developer

"The combination of Step 4 and new seismic requirements is going to make developing multifamily rental in BC nearly impossible. Unfortunately, we know this could be our last hurrah in BC building rental due to the massive rising costs."

- BC Multifamily Developer

“We don’t want to overstate the impact that this policy may have on supply, though the added inspections and cost, on top of other regulatory challenges and high rates, are deterring at least some builders from taking a more aggressive approach to development in BC.

If it becomes clear that these measures translate into additional unit values or rental rates, or as costs come down and new building methods become more common, it is possible that this policy will have little effect on supply.

However, in the interim, investors should expect that the BC Energy Step Code will result in higher building costs and a possible slowdown in new supply being brought to market.

Impact on current and future deals

The likely decrease in supply from the resulting policy will likely mean markets that are already facing prohibitive vacancy rates will continue to struggle in their fight against lack of housing. This potentially bodes well for existing assets and their valuations, though will likely have a net-zero effect for new developments as the newer costs are offset by either higher rents or higher asking prices.

This transition period means underwriting newer deals requires closer attention. Determining whether the developer has the expertise to deliver is key, and so is having a thorough understanding of the new development and construction costs. Finally, developments that will be completed prior to the policy’s milestones are likely to benefit from a potential slowdown in builds and deliveries as they complete at a time that operators are continuing to scramble to understand how to best approach a site’s potential.

At Hawkeye Wealth, we strive to stay ahead of such changes to make sure we bring only experienced operators with solid deals to your inbox. If you want to learn more about the work we are doing in the background as well as hear more about any upcoming deal we have in the pipeline, get in touch at info@hawkeyewealth.com.